how are qualified annuities taxed

Annuity taxation depends on the type. You fund a qualified annuity with pre-tax money money you have yet to pay taxes on.

How To Buy An Annuity Morningstar

That confers certain advantages.

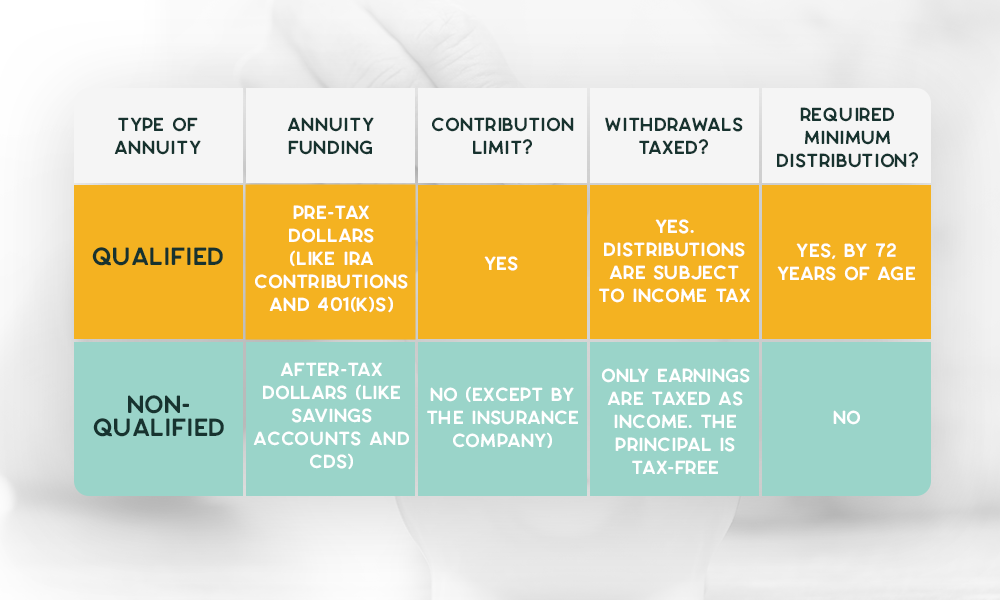

. Variable annuities - make payments to an annuitant varying in amount. A qualified annuity is distinguished from a non-qualified annuity which is funded by post-tax dollars. A non-qualified annuity is funded with money thats already been taxed.

How Qualified Annuities Are Taxed. Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time. Qualified annuities are those purchased through a qualified plan like a 401k or SIMPLE IRA and are normally paid for with pre-tax dollars.

In general annuities are taxed differently if they are in a qualified or non-qualified account. When you inherit an annuity the tax rules are similar to everything described above. In this case the tax rules governing.

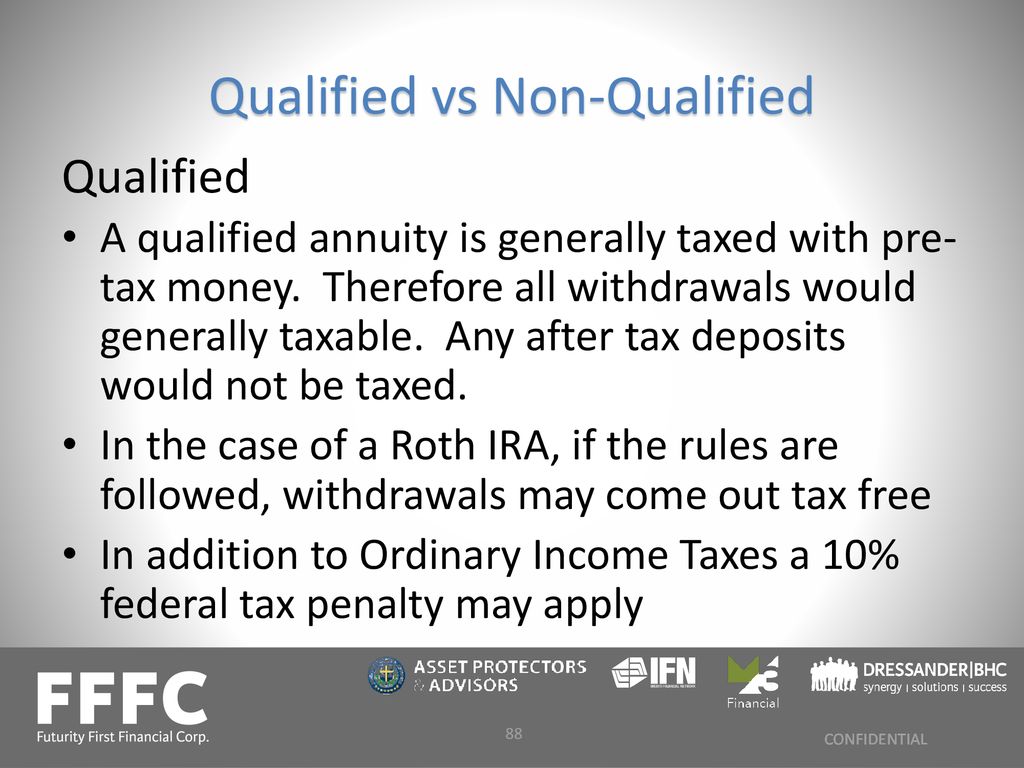

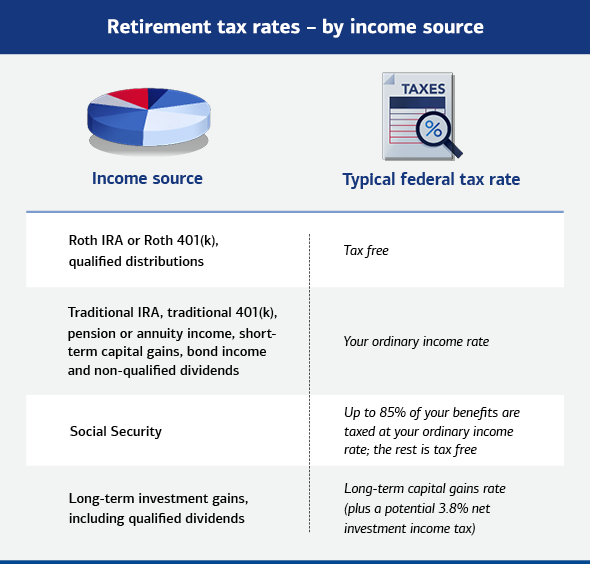

What Is A Qualified Annuity. However the money in a qualified Roth annuity has already been taxed ie they are after-tax dollars. A Roth annuity can be part of a Roth 401k or Roth IRA.

The interest and earnings pulled out of a non-qualified annuity are subject to ordinary federal tax rates rather than long-term capital gains. On the other hand the principal. Two types of annuities exist.

However qualified and non-qualified annuities have. Qualified annuities are purchased with pretax funds. A non-qualified annuity is an annuity bought with after-tax dollars whereas a qualified annuity is an annuity bought with pretax dollars in most cases.

Qualified annuity distributions are fully taxable. An annuity bought with pre-tax dollars is considered a qualified annuity. Qualified annuities are generally funded with pre-tax dollars however Roth annuities are funded with after tax money.

Funds for a qualified annuity typically come directly from a 401k a. Nonqualified variable annuities dont entitle you to a tax deduction for your contributions but your investment will grow tax-deferred. Annuities are tax-advantaged insurance contracts in which you can save for retirement and from which you can receive a stream of guaranteed income.

Your tax liability depends on whether your annuity is qualified or non-qualified. Qualified annuities are usually funds from an IRA or a 401 k. Generally a qualified annuity is funded with pre-tax dollars while a non-qualified annuity is funded with after-tax dollars.

How Do Taxes Work With an Annuity. Federal income tax must be paid on the full amount of. An immediate annuity can be purchased with pre-tax money qualified annuities or post-tax money non-qualified annuities.

Lump-sum distributions withdrawals from. A qualified annuity is an annuity that meets the requirements of Internal Revenue Code section 401a and is therefore eligible for certain tax benefits. Taxation of qualified annuities.

There are no contribution limits and income payments from the principal. When you make withdrawals. Here are the differences for tax purposes.

Annuity Tax Forms For Qualified And Non Qualified Income Annuities

Understanding Annuities Ppt Download

Annuity Taxation Fisher Investments

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

Qualified Vs Non Qualified Annuities Smartasset

Taxes In Retirement Reducing Taxes On Your Retirement Savings

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

How Annuities Can Boost Your Retirement Savings Pacific Life

Annuity Exclusion Ratio What It Is And How To Use It 2022

How Are Annuities Taxed In Retirement How To Reduce Taxes

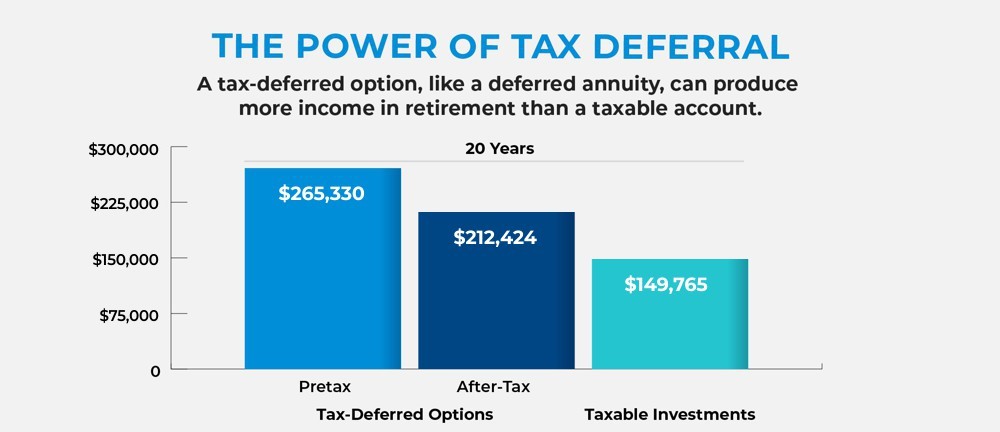

Tax Deferral How Do Tax Deferred Products Work

:max_bytes(150000):strip_icc()/GettyImages-1315440311-ddb35fb5b9494d7289966c78d62b73fb.jpg)

What Are Non Qualified Annuities

Annuity Taxation How Are Annuities Taxed

The Impact Of The Secure Act On Qualified And Non Qualified Annuities New Jersey Law Journal

Substantial Gains In Your Non Qualified Annuities You Ve Got Options

Trust Vs Restricted Payout As Annuity Beneficiary